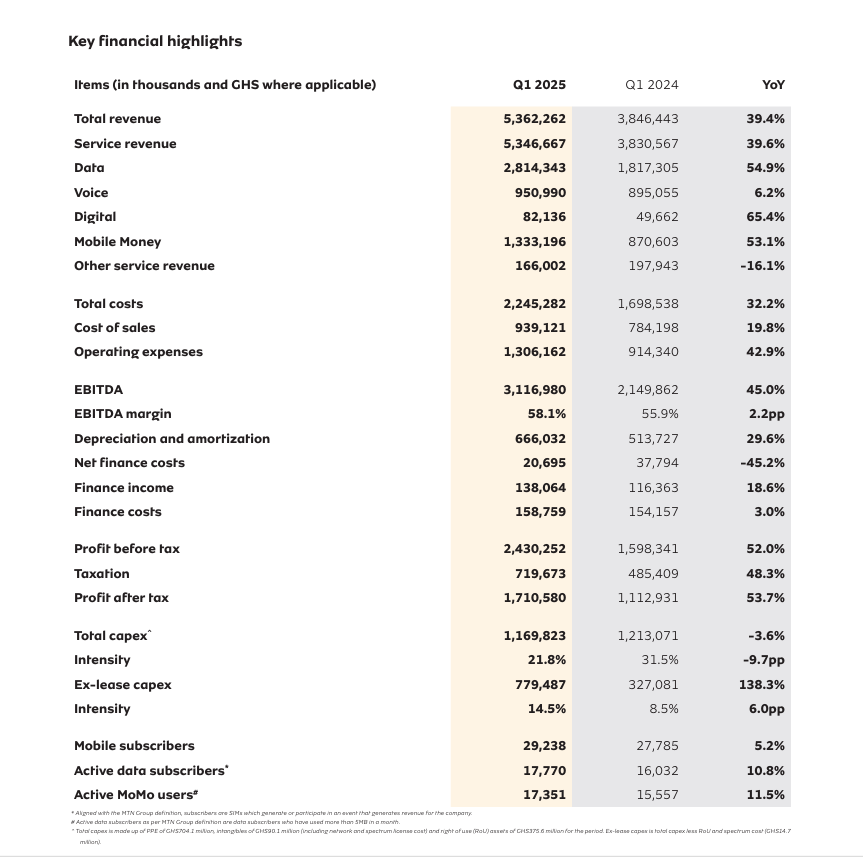

MTN Ghana has recorded total revenue of about GH₵5.4 billion (GH₵5,362,262,000), representing 39.4 percent increase for the first quarter (Q1) of 2025 compared to the same period last year.

The company also posted a profit after tax of over GH₵1.7 billion (GH₵1,710,580,000) for the same period. This was contained in the company’s financial performance from January to March 2025 published by the Ghana Stock Exchange.

The Chief Executive Officer of MTN Ghana, Stephen Blewett attributed the performance to strategic initiatives and investments across key business lines such as data, digital services, voice communications and Mobile Money.

“The first quarter of 2025 was characterised by solid execution of our commercial strategy, culminating in a 5.2% expansion of our subscriber base and a 39.6% increase in service revenue”, he added.

According to the statement, service revenue increased by 39.6 percent to about GH₵5.35 billion compared to the same period last year.

Total profit before tax for period stood at GH₵2.4 billion (GH₵2,430,252,000).

The company paid a profit tax of GH₵719.7 million, which is about twice what it paid (48% +) for the same period under review.

Total capital expenditure (capex) stood at GH₵1.17 billion. This is 3.6 percent less than what the company invested in the first quarter of the same period last year.

Operational and financial review

Service revenue

The company said its service revenue increased by 39.6 percent Year on Year (YoY) to GH₵5.4 billion, despite the macro headwinds that characterised the first quarter of the year.

This growth surpassed its medium-term guidance and the average inflation for the period.

The rise in top-line revenue was driven by greater usage and demand for MTN’s connectivity and fintech services, enabled by ongoing investments and enhancements to its network and service delivery.

“We invested GH₵779.5 million in ex-lease capex to maintain network quality, expand coverage and capacity, and enhance our IT systems. These investments supported an increase of 1.5 million mobile subscribers, bringing the total to 29.2 million, while also improving network resilience and sustaining a 4G population coverage of 99.3% by the end of Q1 2025”

Data revenue

Data revenue increased by 54.9 percent YoY, reaching GH₵2.8 billion. This growth was largely driven by a 10.8% YoY increase in active subscribers and continuous momentum in usage, fuelled by an enhanced value proposition and promotional data bundles.

According to MTN, its investments towards expanding network capacity and improving customer experience have supported overall data growth and increased our data subscriber acquisition and retention, which resulted in a 10.8% YoY increase in active subscribers.

Data consumption per month per active user (megabytes) increased by 39.7% YoY to 13.4GB. The share of data revenue to total service revenue increased to 52.6%, compared to 47.4% last year.

Voice revenue

Voice revenue growth showed a positive turnaround compared to the previous year. Revenue in Q1 increased by 6.2% YoY to GH₵951.0 million. The revenue growth was supported by a 5.2% YoY increase in mobile subscribers. Usage was complemented by enhancements in call quality and portfolio optimisations.

Although we continue to observe shifts from traditional calls to Voice over Internet Protocol (VoIP) services, our CVM initiatives and other portfolio optimisation efforts have helped mitigate the impact on revenue.

The contribution of voice revenue to total service revenue declined to 17.8% compared to 24.3% last year, reflecting the ongoing transition towards faster-growing products and services such as data.

Digital revenue

Digital revenue recorded a growth of 65.4% YoY, reaching GH₵82.1 million. This growth results from the proactive improvements to gaming services, video streaming, and personalised call-back ringtone options, which have attracted a larger audience and encouraged existing subscribers to explore our digital offerings.

“We have also expanded partnerships with content providers, leading to exclusive music, TV, gaming, and entertainment content that resonates with our subscribers. The number of active users of our digital services increased by 14.7% YoY to 5.3 million, highlighting the increasing significance of digital experiences. The contribution of digital revenue to total service revenue rose to 1.5% (2024: 1.3%)”, the statement said.

Mobile Money

Mobile Money continued to drive resilient growth by enabling consumers and businesses throughout Ghana. Revenue increased by 53.1% YoY to GHS1.3 billion.

This growth was supported by a 44.8% YoY rise in revenue from basic services and a 72.4% YoY boost in advanced service revenue.

The growth in advanced services underscores the partnerships with fintech ecosystem players and financial institutions to broaden access to digital payments, lending, and wealth management services.

The revenue growth was further bolstered by an 11.5% YoY increase in active users and a YoY rise in transaction volume (19.7%) and value (94.8%) processed on the MoMo platform. The contribution of MoMo revenue to total service revenue increased to 24.9% (2024: 22.7%).

Source: Lawrence Segbefia