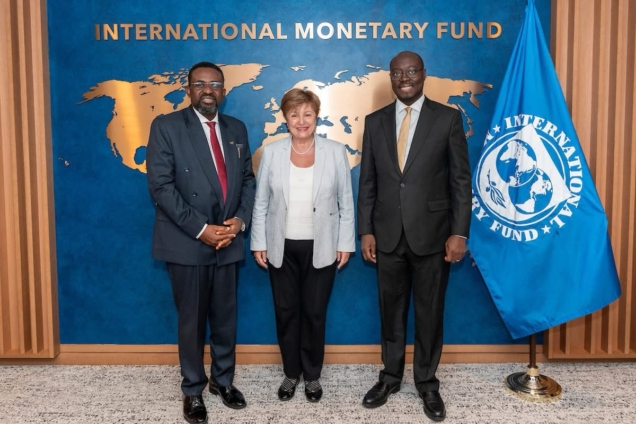

An International Monetary Fund (IMF) staff mission is expected in Accra from September 29, 2025, for Ghana’s 5th programme review.

The exercise will assess how Ghana has performed under the IMF programme since completing the 4th review earlier this year.

This will be the penultimate review, with the final one scheduled for April 2026 before Ghana concludes the programme in May 2026.

The 5th review is considered particularly important, as some market analysts fear Ghana may struggle to maintain fiscal discipline once the programme ends.

Development partners are, therefore, urging the institution of “shock absorbers” to prevent economic instability after May 2026.

Government, however, insists there is no cause for alarm, stressing that it has already taken steps to assure markets of expenditure discipline post-programme.

If Ghana passes this 5th review, about $360 million is expected to be disbursed in October 2025. So far, Ghana has received approximately $2.3 billion since signing onto the IMF programme.

Focus of the 5th Programme Review

Joy Business has gathered that the review will focus on Ghana’s economic data ending June 2025. Key areas of discussion include:

- Inflation performance.

- Sustainability of reserve build-up.

- Audit of arrears.

- Weak private sector banks require recapitalisation.

- State-owned banks needing recapitalisation, similar to NIB.

- Fiscal policy shortfalls in the face of an appreciated currency, with adjustments needed to meet the 1.5% of GDP primary surplus target.

- Arrears build-up in NHIL, GETFund, Road Fund, and other areas.

- Social spending shortfalls.

Ghana’s IMF Programme and Priorities

On May 17, 2023, the IMF Executive Board approved an SDR 2.242 billion (about US$3 billion) 36-month Extended Credit Facility (ECF) arrangement for Ghana. This decision allowed for an immediate disbursement equivalent to SDR 451.4 million (about US$600 million), with the rest disbursed in tranches every six months following programme reviews.

The programme seeks to:

- Restore public finances to a sustainable path through revenue mobilisation and improved spending efficiency, while protecting the vulnerable. For example, allocations to the LEAP cash transfer programme and the school feeding programme have doubled under recent budgets.

- Support fiscal adjustment and resilience with structural reforms in tax policy, revenue administration, public financial management, energy, and cocoa.

- Curb inflation, with the Bank of Ghana raising interest rates and ending monetary financing of the budget, while maintaining a flexible exchange rate to rebuild reserves.

- Preserve financial stability.

- Encourage private investment, growth, and job creation through broader reforms.