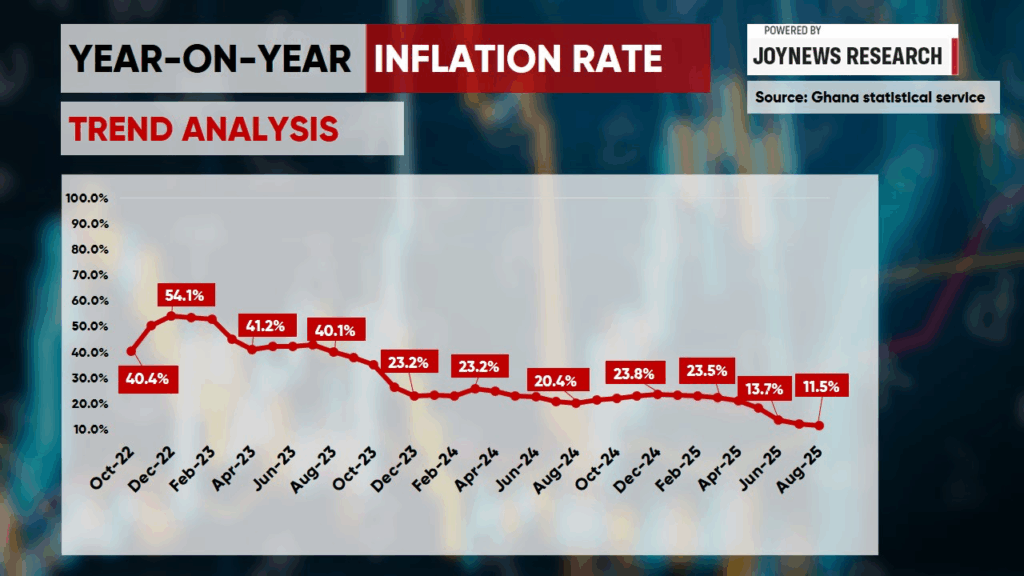

Ghana’s year-on-year inflation slowed to 11.5 % in August 2025, the Ghana Statistical Service reported, extending a steady disinflation path that began after the sharp price spikes of late 2024.

The August print also recorded a month-on-month decline of 1.3 %, a sign that price pressures eased across several categories during the month.

Food and non-alcoholic beverages remain the principal source of inflationary pressure, the group recorded 14.8 % year-on-year inflation in August, compared with 8.7% for non-food items.

The August outcome places the country close to the government’s 2025 target of 11.9%, as stated in the national budget.

This is significant because it comes against a backdrop of differing external forecasts.

In April 2025, the International Monetary Fund (IMF) projected a much higher end-year rate of about 17.5% for 2025, reflecting a cautious view of how quickly price pressures and structural imbalances could be resolved.

However, after the year-on-year inflation dropped sharply in June from 18.4% to 13.7%, the IMF revised its forecast downward, projecting an end-year rate of 12%.

The IMF’s medium-term outlook remains optimistic, anticipating that inflation will fall to single digits by the end of 2026 if planned macroeconomic adjustments stay on track.

Two features dominate the current snapshot.

First, headline inflation has come down markedly from the very high rates seen at the end of 2024, when year-on-year figures were above 20%.

Second, the disinflation is uneven: food inflation is still substantially higher than non-food inflation, and several regions continue to experience double-digit price growth according to the consumer price index bulletin by the Ghana Statistical Service.

Why the decline to 11.5%?

The recent fall reflects a combination of factors that pushed aggregate price momentum lower in the short term. Seasonally softer food prices in some markets, improved supply conditions for key staples in certain regions, and a period of relative stability in the cedi have all helped ease imported cost pressures. Monetary policy tightening in earlier months also weighed on demand growth and helped anchor inflation expectations.

That said, the durability of the decline depends on whether these drivers hold and whether fiscal and monetary authorities avoid policy slippage.

Even though inflation is going down, prices are still high, and many individuals are still concerned about the cost of basic things like food and utilities compared to a few years ago.

For businesses and investors, the big question is whether prices will keep falling and if government will stay disciplined with spending and interest rate decisions to keep inflation under control.

What to watch next:

In the coming months, it will be important to watch the next CPI (inflation) figures, how the cedi performs, and what decisions the Bank of Ghana makes about interest rates.

People will also be looking at government spending to see if it stays within budget. Harvest results and market prices for food will play a big role in whether food costs go up or down.

The August print is a measurable improvement and brings the government even below its stated target. But the remainder of 2025 will determine whether the decline is consolidated or merely a temporary easing.

If exchange-rate stability, subdued food inflation and fiscal discipline persist, the path toward single-digit inflation in 2026, as the IMF projects under its baseline becomes more plausible.

If any of those elements falter, the year-end outcome could move back toward the higher rates flagged by external forecasters.

For now, the data show a promising direction; the policy choices and external shocks that follow will shape whether that direction holds.